Digging For Due Diligence

Copper Mining isn't as simple as find rock, dig rock, sell rock: instead, it is a marvelously complex process where poor decisions and cutting corners on due diligence can result in billions lost.

Is the energy transition resource constrained?

Some argue that calculating the vast materials required by wind, solar, and EVs is merely academic and misses the fact that mining output seems to increase, always responding to demand. All we need is a little faith and money, and we can mine whatever we need for a green utopia.

To wrestle with that question, let’s start with a story of both success and fraud.

In 1936, the three men pictured below (courtesy of Wikipedia) climbed and explored the ~16,000ft Sudirman Mountain Range on the Island of New Guinea. One of the men, Dutch geologist Jean-Jaques Dozy, discovered a potential mineral deposit during the expedition. Upon his return, he wrote a paper estimating the potential resources. Yet his work was soon drowned out by the noise of WW2.

It wasn’t until the 1950s that his work was ‘rediscovered’ by Freeport, a major mining operation. Freeport backed the exploration and developed infrastructure in the middle of the jungle. Opened in 1972, the Grasberg mine is a marvel of modern engineering. Built nearly 14,000ft above sea-level in the midst of Indonesia’s rugged mountains, the mine and nearby mineral district now contains one of the world’s largest gold and copper reserves.

Photo By Richard Jones

While Grasberg was a major success, a Canadian junior mining company named Bre-X set out to find its own massive discovery. Bre-x purchased a mining claim in Busang, Indonesia and started drilling for rock samples. In 1994, lab results indicated that Bre-x struck gold.

The next few years were a frenzy of excitement. Exploration and lab results kept ‘confirming’ the initial reports. Bre-X’s stock skyrocketed from $0.30 to $250+, with major financial institutions talking up what just might be the largest gold find in a decade. Even Freeport got into the action and entered a joint venture with Bre-X and the Indonesian government to explore and develop Busang.

Yet in 1997, a fire destroyed most of the Bre-x sample records. That same year, Freeport drilled and analyzed its own samples from the same locations Bre-x had drilled. When Freeport sent those rock samples off to the lab, results were starkly different, showing very little gold, far below the results reported by Bre-X’s project manager Michael de Guzman. In fact, the biggest discovery of the mining venture was that de Guzman purchased gold panned from the nearby rivers and sprinkled it into the rock samples, greatly inflating the original deposit estimates.

As the fraud began to unravel, de Guzman supposedly fell to his death from a helicopter over the Indonesian jungle. Officially, his death was ruled a suicide. Yet rumors circulated that his death was staged and that he’s alive, hiding from the authorities.

As news of the scam spread, Bre-x’s stock prices plunged. Investorpedia described the fallout:

“From a peak valuation of over $6 billion Canadian dollars (CAD), Bre-X’s shares collapsed and the company soon filed for bankruptcy. Among the many victims of the Bre-X scandal were Canadian pension funds such as the Ontario Teachers Pension Plan and the Quebec Public Sector Pension Fund, which faced combined losses of over $150 million CAD.”

In the wake of the scandal, the Canadian government greatly increased mineral reporting requirements, known as National Instrument 43 standards.

This story of fraud and scandal highlight the complexity and difficulty of exploring for resources and the critical importance of independent due diligence. For Bre-x, you could pan bits of gold from nearby rivers. But knowing if a major deposit exists and where it exists, is a vastly different story.

While it’s hard to say, estimates range from 1 in 1000 mineral prospects to as low as 1 in 10,000 mineral prospects actually result in a mine. Of course, some of those prospects get recycled back when the next commodity boom happens, and may turn into major mines.

Mining isn’t a franchise operation where we drop cookie cutter, modular mines into the ground. Rather, it’s a complex operation to identify and map out each unique deposit. Going from a prospective resource to a proved reserve is an example of how real science is supposed to work: dispassionately making observations, forming a hypothesis, and proving or disproving it with lots of evidence. The more evidence you collect and analyze, the more confidently you can answer these questions:

Does a deposit exist?

What kind is it?

How big is it?

And, is it economically viable?

Answering those questions requires extensive geological surveys, mapping, gathering ore samples, laboratory work, engineering designs and economic reports.

So how much exploration happens? Let’s look at a real world timeline from Highland Copper’s 489-page feasibility study on a relatively small proposed mine in Michigan. Notice how many companies explored the area and how much drilling was done since the 1950s. ( This is not investment advice, it’s just an example.)

If we go back to Grasberg, there’s still much to learn about the deposit, decades into production. In just one underground part of the mine (BG), exploratory drilling started in the early 1990s. In just that section alone, they’ve drilled over 1000 assay holes and gathered 25,000+ rock samples. Despite the extensive work, drilling continues, expanding the knowledge of the ore types, ore grades and cut-off points.

Ore Types

We can break ore types into two generalized buckets: oxides and sulfides. Ores weatherized by water and oxygen become oxides, un-weatherized ores are sulfides (loosely speaking). Oxides ***tend*** to be closer to the surface and are easier to process while sulfides *** tend*** to be deeper and harder to process.

Oxide ores can be crushed, piled into a heap, and then sprayed with acid in a process known as ‘heap leaching.’ Then, the copper is removed from the solvent with electricity. This process can be simpler and doesn’t need lots of heat.

On the other hand, sulfide ores tend to need more processing and lots of heat. They’re crushed up into a really fine powder, mixed with chemicals to form a ‘concentrate.’ That concentrate is shipped to a smelter. Smelters require intense heat to separate impurities from the concentrate. Then, electricity can also be used to ‘finish’ the product.

Ore Grade

Ore grade estimates the amount of valuable mineral in the rock. The lower the grade, the more rocks you need to dig up, crush, and process to get the same amount of metal. While ore concentration varies, let’s compare a few common types:

For 1 ton of iron, you’ll need~ 1.6 tons of ore.

For 1 ton of aluminum, you’ll might need ~ 4-5 tons of ore.

For 1 ton of copper, you’ll need ~ 50-200 tons of ore.

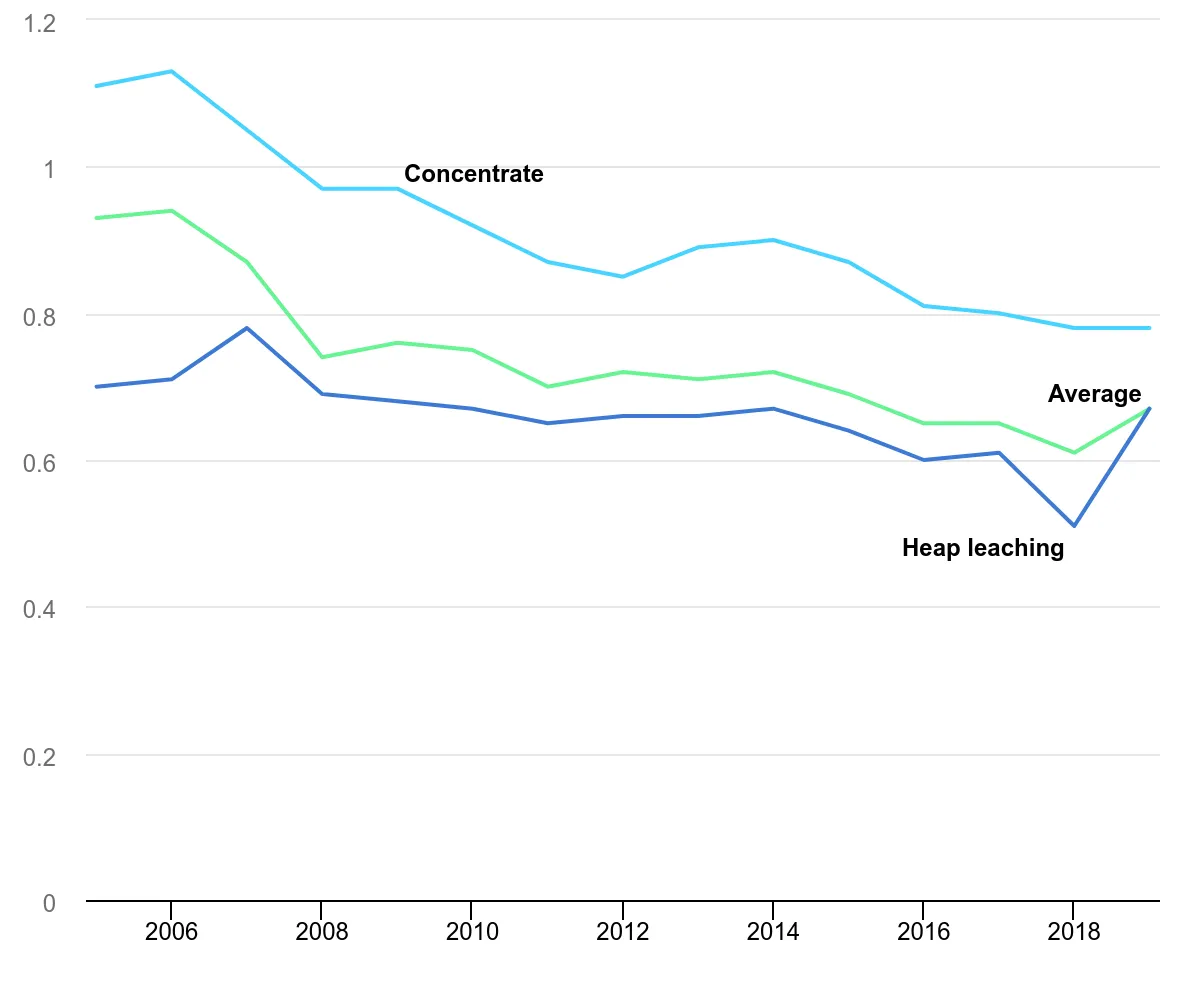

In the world’s largest copper mining nation, Chile, copper ore grades declined overtime to less than 0.8%.

There are outliers, like the relatively new Kamoa-Kakula mine in the Congo. In 2023, Kamoa produced ~ 5.55% copper ore grade. Globally, most major mines have ore grades of 2% or less. According to a 2022 technical report,Grasberg’s average reserve ore grade varies from 0.85% to 2.25%, depending on the mine section.

So how low of an ore grade can you profitably mine?

It depends on the depth, complexity, and price of copper and can vary even at the same mine. Copper mining often digs up a basket of minerals, and can include gold or silver, impacting the breakeven point.

For Grasberg, the cut-off point in one section is ~ 1.27% ore grade. Yet in other more easily accessible parts of the mine, the cut off grade drops to 0.63% (at $2.50 Copper).

Pulling In Opposite Directions

From digging up the ore, crushing it, shipping concentrate to smelters, melting down the concentrate, and using electricity to finalize it, the entire copper mining industry is very energy hungy.

Yet, to appease the Net Zero gods, the ESG crowd wants to decarbonize the industry, an industry that needs reliable, 24/7/365 power. This will inflate costs. The International Copper Association estimates that decarbonization alone requires a minimum of $110 billion, in an industry that only produces ~22million tonnes a year. That’s ~$5000 (US) of additional capx per tonne of annual output. That same report estimates that most mines only require $13,500 of capx per a tonne of annual output.

This would change which mines are profitable, and which ones aren’t. The ESG crowd demands a very expensive redesign of an industry while simultaneously demanding vastly increased output. What could go wrong?

Putting In All Together

So where does copper come from? While it depends on the year, generally copper mining accounts for ~80% of ‘new’ supply, and ~ 20% of ‘new’ copper is recycled from discarded products. The International Copper Association has detailed flow charts that can be viewed here.

Chile is the world’s largest copper miner, followed by Peru and the Congo. Those three countries mine ~46% of raw copper minerals. Globally, 13 nations produce 89% of copper mine output.

China handles about ~44% of the world’s refining in 2023, yet China also consumes nearly 1/2 of the world’s refined copper.

Rate Setters

The most time consuming and riskiest part of mining is the due diligence, coupled with the political and permitting risks, the struggles to find patient capital willing to bet on a project, and finding the processing off-takers necessary to handle the ore once it is mined. This takes skilled professionals, time and money to gain and understand the accurate, reliable, and detailed information necessary to avoid billion dollar ‘oopsies.’

To put that in perspective, the IEA estimated that for mines coming on line between 2010 and 2019, it took an average of ~12 years to discover, explore, and complete the necessary studies.

Just like mines, geologists and mining engineers aren’t just picked from a tree ready to go. Deloitte publishes statistics on mining engineering degrees, giving us an idea of how many skilled professionals are entering the workforce. In 2022, the US awarded only ~337 degrees in Geology and just ~ 312 mining engineering degrees. And that’s out of a nation of ~330 million with a government that thinks we’ll vastly increase our copper and critical minerals needs for a green ‘transition’ while at the same time re-shoring that industry, and doing all of that in -effectively speaking- a blink of an eye.

We’ll close with one last chart. Over the past 50 years, copper mining grew about 2.3% a year, from 6.9 Million Metric Tonnes in 1973 to approximately 22 million metric tonnes in 2023. Yet, the world’s population grew from ~ 2.6 billion to ~8 billion. That means the global copper mining industry produces about 2.75kgs of copper (~6lbs) per person per year.

Now for those who think we can all drive EVs in just a few years, one EV uses 2, 3, or even 4x the amount of copper as a ‘regular’ car. Depending on the source, an EV might use around 53-73KGs of copper. If you could only use ‘your share’ of global copper mining output, it would take ~19-27 years to save up enough copper for 1 EV.

As always, thanks for reading!

Fantastic article. On many levels, from the details of a difficult industry to the almost unfathomable disconnect with green goals.

Excellent comprehensive article. Should be required reading in general, so people can get an idea where copper comes from.

Separating the dilute copper from massive volumes of unwanted materials is extremely energy intensive and can be costly.

The same is true for carbon capture and storage. In compliment see:

https://tucoschild.substack.com/p/carbon-capture-green-grift-and-taxpayers